Technical Analysis

🔍 What Is Technical Analysis

Technical analysis uses historical price data and chart patterns to predict future market behaviour. Unlike fundamental analysis (which evaluates a company’s intrinsic value), technical analysis is all about price action, momentum, and timing trades.

Introduciton-to-Technical-Analysis.pdf

📊 Reading Candlestick Charts

Candlestick charts provide 5 key data points:

-

Open

-

Close

-

High of Day (HOD)

-

Low of Day (LOD)

-

Direction of movement (bullish or bearish)

Each candlestick represents a fixed time (e.g., 1 day, 1 hour, etc.). Longer timeframes usually offer more reliable trends.

✅ Recommended Tool:

tradingview.com for real-time candlestick charts.

⚓ Support and Resistance

-

Support = historical buying zones (price bounces up)

-

Resistance = historical selling zones (price bounces down)

-

Once broken, these levels often flip roles.

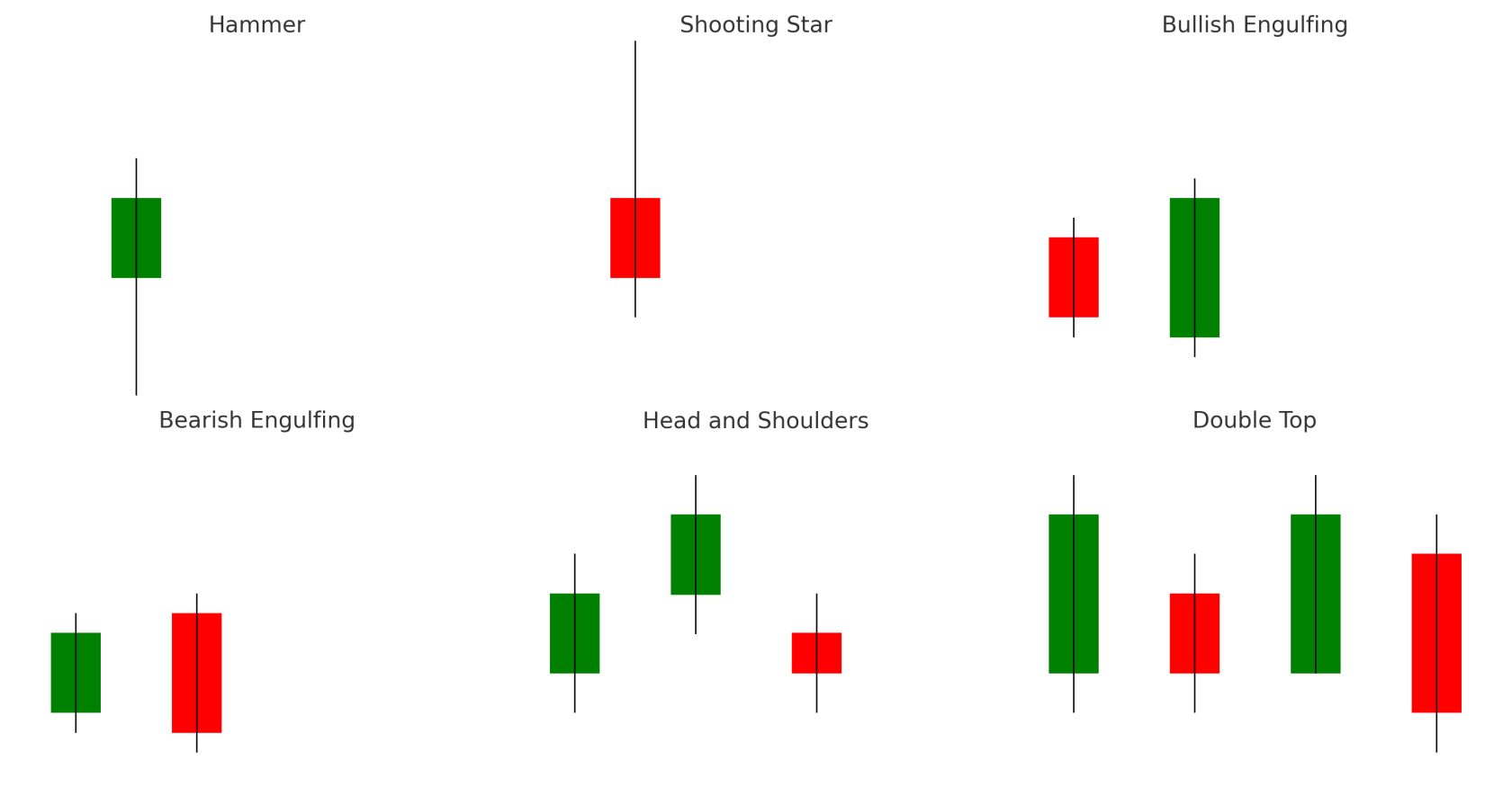

🕯️ Common Candlestick Patterns

1. Hammer

-

Green candle, long lower wick

-

Indicates bullish reversal

2. Shooting Star

-

Red candle, long upper wick

-

Indicates bearish reversal

3. Bullish Engulfing

-

Large green candle completely engulfs prior red candle

-

Signals buyer dominance

4. Bearish Engulfing

-

Large red candle completely engulfs prior green candle

-

Signals seller dominance

📈 Common Chart Patterns

1. Head and Shoulders

-

Indicates trend reversal from uptrend to downtrend

-

Inverse pattern signals reversal into an uptrend

2. Double Top & Double Bottom

-

Double Top = Bearish (two peaks)

-

Double Bottom = Bullish (two troughs)

📉 Key Technical Indicators

1. RSI (Relative Strength Index)

-

Measures momentum (0–100 scale)

-

Overbought: above 70

-

Oversold: below 30

-

Divergence between RSI and price can signal trend reversals.

2. MACD (Moving Average Convergence Divergence)

-

Uses EMAs (12-period & 26-period) to track trend momentum

-

Crossovers indicate potential buy/sell signals

3. Bollinger Bands

-

Based on SMA and standard deviation

-

Bands contract = low volatility

-

Bands expand = high volatility

-

Best for identifying breakouts or "squeeze" conditions

💡 Final Tips

-

Combine 3–5 indicators for higher probability trades

-

Always use stop-losses

-

Patterns are not always reliable, use confluence

-

Technical analysis works best when multiple signals align

Further reading

No comments to display

No comments to display